Overview of Singapore Corporate Tax

Did you know that Singapore doesn’t have Value-Added Tax, but the Goods and Services Tax (GST) instead? How does zero percent GST for businesses providing international services sound to your company? What is the tax exemption scheme for new start-up companies?

In this article, we will provide an overview of corporate tax in Singapore, GST rates for local and international services, tax exemption schemes and corporate income tax rebates.

Overview of Corporate Income Tax in Singapore

Singapore generally imposes income tax on a territorial basis, so only oncome accruing in or derived from Singapore or foreign-sourced income received or deemed received in Singapore is subject to Singapore income tax. A company is taxed on the income earned in the preceding financial year. This means that income earned in the financial year 2015 will be taxed in 2016. With effect from YA 2010, a company is taxed at a flat rate of 17% on its chargeable income regardless of whether it is a local or foreign company.

Goods and Services Tax (GST)

Implemented on 1st April 1994 in Singapore, Goods and Services Tax (GST) Act is a broad-based consumption tax levied on the import of goods (collected by Singapore Customs), as well as nearly all supplies of goods and services in Singapore. In other countries, it is commonly known as the Value-Added Tax (VAT).

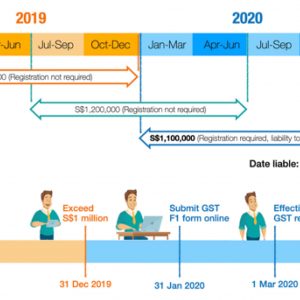

Presently, the Inland Revenue Authority of Singapore (IRAS) acts as the agent of the Singapore government and administers, assesses, collects and enforces payment of GST. The current rate of GST is 7%. If your annual taxable supplies exceed $1million, it is compulsory for you to register for GST. Otherwise, you may choose to register for GST voluntarily after careful consideration.

Zero GST on Businesses Providing International Services

Your services are considered international services, which are zero-rated (i.e. GST is charged at 0%), if they fall within the provisions under Section 21(3) of the GST Act. Depending on the nature of your services, you may be required to determine your customer’s belonging status (i.e. whether the customer is a local or an overseas entity) before your supply of services can be zero-rated.

Tax Exemption Scheme for New Start-up Companies

For newly incorporated Singapore companies which are Singapore tax resident, Singapore has introduced the tax exemption scheme to encourage entrepreneurship and to aid growth of local business. To qualify, the company must not have more than 20 shareholders throughout the basis period if:

- All the shareholders are individuals directly and beneficially holding the shares; or

- At least one shareholder is an individual beneficially and directly holding at least 10% of the ordinary shares of the company.

Change of Tax Exemption Scheme for New Start-Up Companies in Y2020 onward

|

Chargeable Income |

Tax Exemption (%) |

Amount |

|

First $100,000 |

75% |

$75,000 exempted $25,000 taxable |

|

Next $100,000 |

50% |

$50,000 exempted $50,000 taxable |

The maximum exemption for each YA is $125,000 ($75,000 + $50,000).

The tax payable rate is based on 17% included chargeable income after $200,000

Tax Exemption on First $300,000 of Chargeable Income (where any YA of the first 3 YAs falls in YA 2010 to YA 2019)

|

Chargeable Income |

Tax Exemption (%) |

Amount |

|

First $100,000 |

100% |

$100,000 |

|

Next $200,000 |

50% |

$100,000 exempted $100,000 taxable |

The maximum exemption for each YA is $200,000 ($100,000 + $100,000).

The tax payable rate is based on 17% included chargeable income after $300,000

Rebate on Corporate Income Tax

In the Budget 2020, businesses will get a rebate on corporate income tax and some enhanced tax treatments in moves aimed at improving their cash flow. Companies will be granted a rebate of 25 per cent of tax payable, capped at $15,000, for the year of assessment 2020 – a move that will cost the Government about $400 million. The tax treatment enhancements include automatic extension of interest-free instalments by two months for payment of corporate income tax on estimated chargeable income. Companies should note that:

- It has to be filed within three months of a company’s financial year end.

- Thy will be allowed to carry back the unabsorbed capital allowances and trade losses of up to the three immediate preceding years of assessment.

- They can opt to accelerate the write-off of the costs of acquiring plant and machinery and renovation incurred for the year of assessment 2021.

Read: Singapore Budget 2020: Companies get 25% corporate tax rebate, other measures to improve cash flow

Need support with your corporate taxes or rebates that your company can claim?

Let Acrabiz help you with you as your bookkeeper, tax controller or business consultant for your accounting and finance department today!

Contact Us