With our platform and chartered accountants, your accounting work will be so much easier than before.

1

Keep track with your deadlines of annual filing & tax filing, it is all recorded in the platform. We will pay for your fines if your filings are late.

2

Chat with certified accountant assigned to your company on the platform, they manage your accounts and respond to your questions.

3

System automatically import data from your bank account, your accountant will help you categorize the transactions.

4

Simply snap a photo of any supporting documents and send to us, we will deal with all the paper works if you do not have time.

5

We scan your company letters and upload them everyday, so you won’t miss any important information, we will put a remark sign for you if it is urgent.

6

Platform generates all types of financial reports include P/L, Balance Sheet, Accounting Transactions, Tax Report. Filter for periods and download.

Transfer your Secretary and Accounting Service to us

We will prepare a resolution and add our Secretary on your business registry, and take over the service for your company. All you need to do is sign the resolution. Simple and easy. We charge S$100 to prepare the resolution and do the administrative works.

Choose the plan that suits your business needs

Monthly Bookkeeping Service

For companies with frequent monthly transactions, flexible billing plan while maintaining the daily works

>>Learn More

Yearly Accounting and Taxation Service

For companies with 1-30 transactions yearly, or dormant company

>>Learn More

Monthly Bookkeeping Service

For companies with frequent monthly transactions, flexible billing plan while maintaining the daily works. All packages include:

Starters

S$150/month

30 transactions and

below per month

Growings

S$300/month

31 - 100 transactions

per month

Prosperings

S$500/month

101 - 200 transactions

per month

On Location Support

CPF Submission

Apex

S$800/month

201 - 300 transactionsper month

On Location Support

CPF Submission

Payroll (Up to 10 staff)

More Transactions?

Speak with our corporate care manager

300 transactions and above per month

For companies with 1 - 30 transactions yearly, Billed S$1200 upfront or at the financial year-end.

Yearly Accounting and Taxation Service

We not only help you to keep track of your financial year-end, file your annual return and tax return. As our valued client, our chartered accountant will also answer all your enquiries online.What does the package include?

Annual accounting and taxation service include the following:

- AGM & Annual Filing Submission

- Annual Corporate Tax Computation and Submit Form C-S

- Filling of Estimated Chargeable Income(ECI)

- Prepare Unaudited Financial Reports

- Accounting for Transactions Below 30

- Renewal of 12 Months Corporate Secretary Service After 1 Year

- Renewal of Registered Address After 1 Year

For dormant companies with no transaction Billed financial year-end at S$800

Yearly Accounting and Taxation Service

According to Singapore Company Act, It is necessary for every live company to hold Annual General Meeting and file the Annual Returns as long as the company is reflected as live and even though the company is dormant or has ceased trading.

What does the package include?

Package for dormant company includes the following:

- AGM & Annual Filing Submission

- Corporate Tax Form C-S submission for dormant companies

- Renewal of 12 Months Corporate Secretary Service after 1 year

- Renewal of registered address after 1 year

What documents shall I keep for my business?

Keep properly of the following documents and records when you are running your business

Sales Invoices

Receipts

Payment Voucher File/

Expenses File

Monthly Bank Statements

Petty Cash File(if any)

Monthly CPF Statements(if any)

Monthly Foreign Worker

Levy (if any)

Watch Demo video Understand how it works

Keep properly of the following documents and records when you are running your business

Additional things your may need

| XBRL Filing Services (for insolvent company or company with corporate shareholder) | S$300 |

| Striking off company | S$800 |

| GST Registration Service | S$200 |

| Quarterly GST submission | S$300 |

| Per resolution drafted (For change of shareholder or director, change of address, increase on cpaital etc) | S$100 |

| Trademark Registration | S$1000 |

| Personal Income tax filing | S$500 |

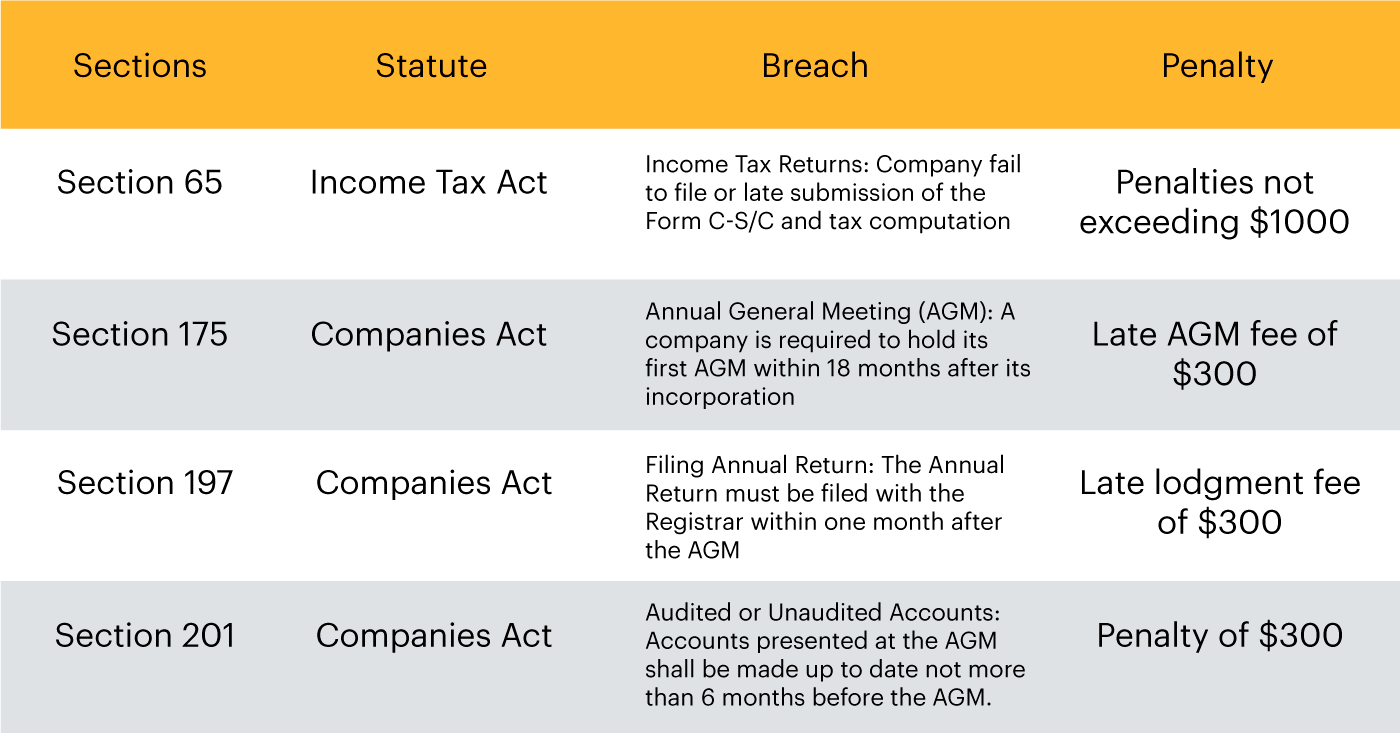

Some information that you would like to know

Q&A

Is bookkeeping compulsory?

All companies registered in Singapore must keep proper books of accounts as stipulated by the Singapore Companies Act. Good bookkeeping not only facilitates day-to-day account maintenance and drafting of financial statements for the submission of annual returns, but also provides insight for sound business decision-making as well as efficient financial management.

What is GST? Do I need to register for GST?

GST stands for Goods and Services Tax. In other countries it is also known as VAT or Value Added Tax.

GST registration is only required for companies that can reasonably expect turnover in the next 12 months to be more than S$1 million. However, a company can also voluntarily register for GST if it is under this threshold.

GST exemptions apply to the provision of most financial services, the supply of digital payment tokens, the sale and lease of residential properties, and the importation and local supply of investment precious metals. Goods that are exported and international services are zero-rated.

What is an annual return (AR)?

An Annual Return (AR) is the annual submission of your companies’ financial health and status to the registrar. Section 197 of the Singapore Companies Act (Cap. 50) states that Annual Return filing has to be done within 1 month or 30 days from the Annual General Meeting (AGM).

Is filing a tax return necessary if my company did not gain any profits for the year?

Yes. Singapore companies are required to file a tax return annually.

Do I have to pay the salary and CPF of the Nominee Director?

No. Apart from the nominal annual fees, you have no responsibility towards the Nominee Director.

Do my company need to have annual audit?

Companies that fulfil two of the following criteria are required to have an annual audit:

- Annual revenue of more than S$10 million

- Total assets of the company value at more than S$10 million

- Number of employees more than 50

What is financial Year

Financial year can be any period. The first financial year of a Singapore company can be up to 18 months and shall be fixed on 12 months thereafter.

When is my company financial year end?

You must decide on the first financial year end (FYE) of your new company. The FYE will determine when your corporate filings and taxes are due. Common choices by companies include 31 March, 30 June, 30 September or 31 December.

When is the deadline for filing my annual return and income tax returns?

File annual returns within five months (for listed companies) or seven months (for non- listed companies) after financial year end.

For companies having a share capital and keeping a branch register outside Singapore, file annual returns within six months (for listed companies) or eight months (for non-listed companies) after financial year end.

Can I request to waive the penalties if I miss the deadlines?

No, you should pay for the penalties and remember to do the annual filing on time. If you engage our accounting service, we will help you track all the deadlines, and all the late penalties will be count on us if we miss any.

What kind of companies would enjoy the tax exemption scheme?

After Year of Assessment 2013 and subsequent YAs, Companies can enjoy the partial tax exemption and tax exemption for new start-up companies.

What is XBRL?

XBRL stands for extensible Business Reporting Language. It is compulsory to do XBRL filling it your Singapore company has corporate shareholder. It is a language for the electronic communication of business and financial data worldwide. As one of the family of “XML” languages, it is becoming a standard means of communicating information between businesses and on the Internet.

Who needs to file financial statement in XBRL format?

All Singapore incorporated companies are required to file financial statements with ACRA, except for those which are exempted. Some companies will file a full set of financial statements in XBRL format, while some others will file only salient financial data in XBRL format and a full set of financial statements in PDF. The filing requirements depend on the type of company you own.

If you own a sole proprietorship, partnership, limited liability partnership, or limited partnership, you are not required to file financial statements with ACRA.

Can I choose the Starters bookkeeping service and upgrade to Growings package or Prosperings package later?

Yes, you can upgrade the bookkeeping packages based on your estimated accounts quantum. However, there will be no refund if the actual transactions are lesser than what you estimated.

What is the lock in period for your bookkeep services?

One year, because we need at least 1 year of your company financial data to prepare annual filling and tax filling.

Why is there additional cost for changing the business information?

This is because our secretary needs to prepare resolution documents for you to consent before proceedings. The fee is to cover administrative and secretarial works.

How will you send the accounts or filing documents to me?

You can login the platform and download all your company documents online.

Can I terminate the accounting service if I have engaged a full time accountant?

Yes, you can terminate the accounting service and secretarial works from us, after you consent, we will delete all your personal and company data from our side.

Get an expertto answer your question