What is GST?

Goods and Services Tax or GST is a broad-based consumption tax levied on the import of goods (collected by Singapore Customs), as well as nearly all supplies of goods and services in Singapore. In other countries, GST is known as the Value-Added Tax or VAT.

In Singapore, GST is charged at the prevailing rate of 7%.

Taxable and Non-Taxable Goods and Services

Refer to the tables to find out which goods or services are taxable or not.

Taxable Supplies

|

Standard-Rated Supplies (GST is charged at 7%) |

Zero-Rated Supplies (GST is charged at 0%) |

|

|

Goods |

Most local sales falls under this category E.g. sale of a laptop in a Singapore retail shop |

Export of Goods E.g. sale of a TV set to the overseas customer where the item is shipped to an overseas address |

|

Services |

Most local provision of services fall under this category E.g. provision of spa services to a customer in Singapore |

Services that are classified as international services E.g. air ticket from Singapore to Thailand (international transportation service) |

Non-Taxable Supplies

|

Exempt Supplies (GST is not applicable) |

Out-of-Scope Supplies (GST is not applicable) |

|

|

Goods |

Sale and rental of unfurnished residential property Importation and local supply of investment precious metals |

Sale where goods are delivered from overseas to another place overseas Private transactions (non-business activities performed without payment or any expectation of return from the recipients) Sales Made Within Free Trade Zone (FTZ) or Zero GST Warehouse |

|

Services |

Financial services E.g. issue of a debt security Digital payment tokens E.g. exchange of Bitcoin for fiat currency |

E.g. Company A has imported goods from overseas and stored them in the FTZ or ZG Warehouse. Company A then sells the goods to Company B, which received the goods within the FTZ or ZG warehouse. |

When do you have to register your business for GST?

If your annual taxable supplies exceed S$1million, it is compulsory for you to register for GST.

Possible scenarios

Hereabouts are some possible situations you might face in your business for better understanding when GST is applicable.

Scenario 1. Local sales exceed 10% of total sales.

Company A has overseas IT contracts worth S$1-2 million. It is confirmed that no GST is payable for international service. However, if total revenue with local income exceeds S$1 million in this financial year-end, should the company register for GST? Should it register after the end of the fiscal year? And after registering GST, should they also pay GST for the previous local sales (IT consultancy, web design, etc.) worth about S$300,000?

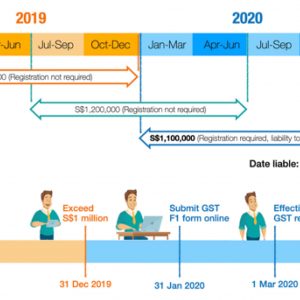

You will be liable to register for GST if your taxable turnover at the end of any calendar year is more than S$1 million (retrospective view) or if at any time, you can reasonably expect your taxable turnover in the next 12 months to be more than S$1 million (prospective view).

Retrospective view

From 1 Jan 2019 onwards, at the end of any calendar year (regardless of your business financial year-end), the total taxable turnover made in Singapore from 1 Jan to 31 Dec (i.e. consecutive months) is more than S$1 million.

If your taxable turnover for the calendar year 2019 did not exceed S$1million, you will not be liable to register for GST under retrospective view.

However, if at any point in time, you forecast and expect the taxable turnover to exceed S$1 million for the next 12 months, you will be liable to register for GST. You will need to register on the 31st day from the date of the forecast.

You can only start charging GST from the effective date of GST registration given to you after approval.

The previous local sales of $300,000 were earned before the company registered for GST. Those are not liable to pay GST.

Scenario 2. Local sales are below 10% of total sales.

For example, sales revenue total is S$5 million.

Example 1

|

Inclusive taxable turnover |

Excluded taxable supplies |

||

|

Local sales of IT service (web design) |

S$300k |

Sale of microchip manufactured in China to Thailand (i.e. out of scope supply) |

S$3 million |

|

International Service (e.g. co-location of the server) |

S$800k |

Sales of workforce IT services from China office to customer in the Philippines |

S$900k |

Total sales are S$5 million. Local sales (S$300,000) is 6% of total sales, but the taxable turnover has exceeded $1million (local sales S$300,000 + international service S$800,000). The company is liable to register for GST.

Example 2

|

Inclusive taxable supplies |

Excluded taxable supplies |

||

|

Local sales of IT service (web design) |

S$300k |

Sale of microchip manufactured in China to Thailand (i.e. out of scope supply) |

S$3 million |

|

International Service (e.g. co-location of the server) |

S$500k |

Sales of workforce IT services from China office to customer in the Philippines |

S$1.2 million |

Total sales are S$5 million. Local sales ($300,000) is 6% of total sales, but taxable turnover did not exceed S$1million (local sales S$300,000 + international service S$500,000). The company is exempt from registering for GST.

GST registration liability is assessed on the total value of taxable supplies exceeding S$1 million and not in terms of the percentage of local sales to total sales.